insider trading malaysia

Essentially insider trading means to buy or sell securities while a person is in possession of material non-public information. Securities Commission Malaysia SC today charged three individuals for insider trading offences under section 188 of the Capital Market and Services Act 2007 CMSA.

Sc Wins Suit Against Lawyer In Worldwide Insider Trading Case The Edge Markets

Insider trading is an offence under the CMSA where the insider can be charged for a criminal offence and upon being convicted the insider can be imprisoned up to 10 years or punished with a fine of not less than RM1 million.

. THE Securities Commission Malaysias intense efforts to stem insider trading was put under the spotlight at the launch of the SCs 2015 annual report recently. However where an insider trades on corporate information a possible theory exists to deem this a breach of his fiduciary. INSIDER TRADING Section 188 of the CMSA 31 Meaning of Insider A director is considered an insider pursuant to Section 1881 of the CMSA if heshe - a is in possession of price-sensitive information which is not generally available.

The law prohibiting insider trading in Malaysia is set out in the Capital Markets and Services Act 2007 CMSA which regulates the. And b knows or ought reasonably to know that the information is not generally. KUALA LUMPUR Nov 4 The High Court has found that the Securities Commission Malaysia SC had successfully proven its claim in a civil suit against Datuk Sreesanthan Eliathamby 60 for insider trading.

Insider trading has received increased regulatory scrutiny in the Malaysian market over the past decade posing several important questions for those who are privy to confidential informationIn the previous article The Edge Issue 1413 March 21 we looked at what exactly insider trading is determining materiality in the context of insider trading as well as the. A person an insider under the law. Positive Average Daily Cumulative Abnormal Volume Turnover ACAVT is considered as possibly insider trading in this study which is suggested by study of Chae 2005 and Sarli.

To Know Part 1 we looked at what exactly is insider trading determining materiality in the context of insider trading as well as the interface between the Capital Markets and Services Act 2007 CMSA and Bursa Malaysias Main Market Listing Requirements Bursas Listing Requirements. The High Court here today affirmed the acquittal of a senior corporate lawyer for alleged insider trading 15 years ago after the prosecution withdrew its appeal. The law prohibiting insider trading in Malaysia is set out in the Capital Markets and Services Act 2007 CMSA which regulates the activities markets and intermediaries in the capital market.

On Dec 23 Cheah Yew Keat the former managing director of DIS Technology Holdings Bhd was convicted of insider trading by the Kuala Lumpur Sessions Court and sentenced to spend one day in jail and to pay a fine of RM1 mil. Esides the characteristics of Malaysias firm which are more likely to. Findings This paper argues that in order to be an.

The Securities Appellate Tribunal SAT has quashed the charges of insider trading in Biocon against Shreehas. Section 188 of CMSA - Insider Trading. Insider trading or dealing is the purchase or sale of a companys securities effected by or on behalf of a person with knowledge of relevant but non-public material information regarding the company that may affect the price of the companys securities price sensitive information if made public.

Purpose This paper aims to gauge the issue of insider trading in Malaysia by assessing some selected statutory provisions under the relevant law and examining the issues of enforcement and prosecution. Designmethodologyapproach The paper analyses relevant legislation pertaining to insider trading. Purpose This paper aims to gauge the issue of insider trading in Malaysia by assessing some selected statutory provisions under the relevant law and examining the issues of enforcement and prosecution.

The charge of insider trading was under Section 1882a of the Capital Markets and Services Act 2007 CMSA. Contrary to popular impression that insider trading is a settled issue due to the lack of investigation and prosecution cases the paper. The main argument against insider trading is that it is unfair and discourages ordinary people from participating in markets making it more difficult for companies to raise capital.

Insider trading Contents SIDREC Providing 2 Impartial Efficient and Effective Dispute Resolution in the Malaysian Capital Market Prohibition against 10 Insider Trading Administrative Actions 16 and Supervisory Engagements Criminal Prosecutions 21. Ewe Lay Peng 45 was charged at the Kuala Lumpur Sessions Court with one count of communicating non-public information between 10 December 2007 and 31 December 2007 to Lim Bun. The key question therefore is what makes a person an insider under the law.

December 1974 INSIDER TRADING IN SINGAPORE AND 335 MALAYSIA as relates to the company and shareholders for the company itself can never be except illegally10 a contractual party in the purchase and sale of its own shares. Sections 183 to 198 set out the specific parameters of what is regarded as insider trading and the applicable. This paper aims to gauge the issue of insider trading in Malaysia by assessing some selected statutory provisions under the relevant law and examining the issues of enforcement and prosecution The paper analyses relevant legislation pertaining to insider trading This paper argues that in order to be an effective regulation the laws enacted must.

SC said High Court judge Azizul Azmi Adnan found that Sreesanthan had breached Section 89E 2 a of the Securities Industry Act 1983. Existence of possibly insider trading in Malaysia equity market. The insider can also be liable for civil remedies where the authority can recover three times of the amount of the.

The penalty of Rs 1 lakh for delayed disclosure under regulation 7 2 a was upheld.

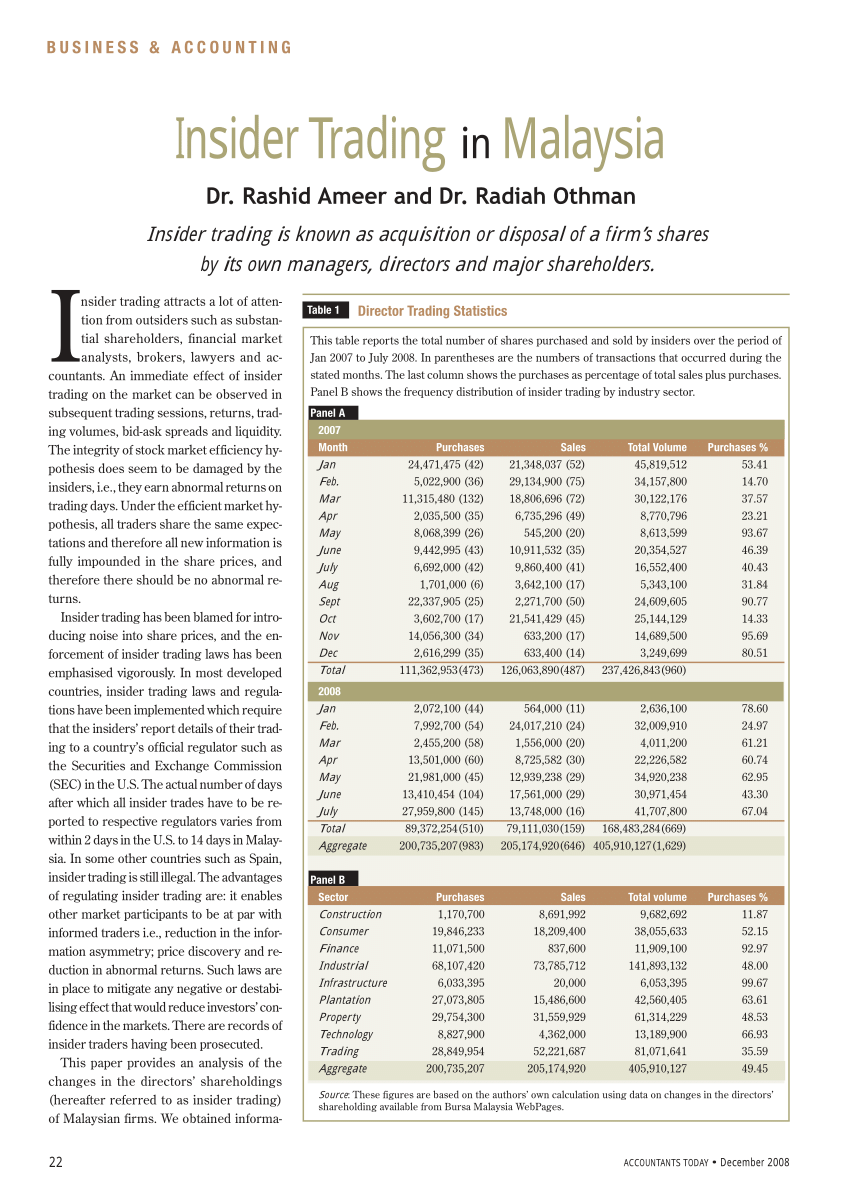

Pdf Insider Trading In Malaysia

Insider Trading Who Is An Insider Case Facts By Hhq Law Firm In Kl Malaysia

Sc Sues Two Individuals For Insider Trading Of Gw Plastics Shares Dayakdaily

Ex Patimas Deputy Chairman Found Guilty For Insider Trading

My Say Action That Can Be Taken For Insider Trading The Edge Markets

Sc Files Appeal Over Lawyer S Acquittal In Sime Darby Insider Trading Case The Edge Markets

My Say What Directors Of Plcs Need To Know About Insider Trading The Edge Markets

Patimas Computers Ex Deputy Chairman Raymond Yap Found Liable For Insider Trading The Edge Markets

Former 3a Director Fang Pleads Guilty To Insider Trading The Star

Market Manipulation And False Trading In Malaysia With Reference To Penalties Azmi Associates

Three A Resources Former Executive Director Pleads Guilty To Insider Trading The Star

Pdf Insider Trading In Malaysia

Pdf Law Enforcement In Malaysian Securities Markets